Table of Contents

Financial flow management is an integral element of each business, regardless of the domain. State-of-art solutions serve as excellent assistants in the performance of this process. Due to this fact, many enterprises have already implemented digital products for accounting in their workflow.

This post discloses the description of accounting solutions architecture, models of such products built from scratch, essential functionality to create, and many more.

» Accounting Tools Significance for Business

What is the key value of such solutions? Primarily, its necessity is conditioned by the fact that money flow occurs in any company, so accounting tools are on-demand for all domains. This type of software is a potent way to streamline the management process of all incoming and outgoing financial operations within the organization. What is more, employees within each company are able to assemble this information for further evaluation and enhanced transparency of money manipulations.

› The main purposes of such systems are:

- Arranging all of the company’s accounting positions

- Manage payroll and taxes

- Accounting analysis with history as well as recent data

- Economic and financial analysis

- Create reports and conclusions based on collected data

Not taking into account if the business is a newcomer or a well-established market player, digital accounting solutions are excellent for overcoming the following list of challenges:

- Manual performance. Due to the opportunity to robotize a vast part of tasks, businesses can cut down the engagement of human resources and, consequently, expenses related to facilitating the department’s functioning. This makes RPA in finance and accounting highly profitable.

- Failure elimination. As it was previously mentioned, the performance of all the tasks necessary for accounting work is one of the most important responsibilities of entities in any industry. Faults in these processes can result in serious problems for a company. Nowadays, the use of technology has made it possible to simplify accounting procedures within companies and eliminate the potential failures provoked by the human factor.

- Enhanced rapidity. Due to liquidating the need to execute accounting processes manually, it has accelerated the operation of accounting activities in your business. Accounting software allows you to stop collecting amounts and performing transactions by involving the special departments, leading to significant time savings and avoiding errors in capture and transactions.

- Data operation. Processing vast amounts of data become much more rapid and more productive, leaving behind a time when physical books or spreadsheets were the only options for operating this information. Apart from this, cloud-based architecture may serve as a perfect environment for accessing this information from any location and device on diverse levels.

One of the big advantages that technology offers is the ability to handle large amounts of data that can be stored and used securely. The architecture of such a solution engages the implementation of a reliable and solid security system. This aspect prevents it from prejudices of business and reduces the chances of financial losses referred to safe issues as well as damage.

» Existing Models of Accounting Solutions

The best way to determine which model is right for you is to analyze and evaluate your company’s challenges and targeting. Let’s take a look at the existing options that can be used to obtain the aforementioned benefits.

› Spreadsheet

It implies standard tables with which you can enter all information, summarize calculations, and organize and structure data. Opportunities for such instruments will be insufficient for huge entities, as the list of functions is pretty short and simple. On the other hand, data organization and structuring capabilities may be essential for startups.

› Off-the-shelf tools

For moderate companies and startups, it’s a great option. Such instruments provide all the essential functionality to execute responsibilities connected with financial management without the need to build a solution from scratch. Yet, the features offered by such products may not comply with your business requirements. This fact makes custom architecture much more profitable.

When applying such tools, you are free of extra outgoings that arise when it comes to the custom software architecture approach. Besides, your accounting department will be provided with primary guidance offered by the platform on how to make maximal use of the system. The process of such tools’ integration with your current workflow occurs much quicker due to the providers’ assistance.

Yet, as it was mentioned above, you won’t be able to properly adapt off-the-shelf software, as there’s no universal tool for all businesses. You may invest in the functionality elements that are excessive for your processes or, conversely, face the features’ insufficiency. What’s more, platform modifications implemented by the provider may result not only in positive outcomes for your business’s work but in negative ones as well.

› Custom accounting products

Such products have functionality that fully reflects the needs of your business and its internal processes. The list of implemented features is tailored to the company’s workflow, which eliminates all unnecessary elements and allows you to implement only the relevant tools. Despite the fact that the price of the scratch architecture is not low, the costs will be quickly recouped by the savings due to process automation, as well as reduced need for human resources.

Such instruments are fully tailored to your business needs, issues, and targets. Furthermore, the process of employee training is performed much faster due to the full reflection of the company’s requirements and maximal customization. Apart from this, it’s much easier to implement a robust architecture that will handle increasing workload within the organization’s expanse.

The main drawbacks of custom solutions for the accounting tasks lie in the longer time required for the creation as well as independence within the updating and support services. However, a vast amount of benefits brought by from-scratch-built software are much more valuable and significant for all market sectors.

» Accounting Solution Building Flow: Integral Stages

Due to the high profitability of the latest model, let’s delve deeper into the indispensable phases to carry out to get a high-quality end result. Traditionally, software engineers and the other experts engaged in the project carry out the steps as described below:

› Project concept

The starting point of the accounting software is a joint discussion between the technical team and the customer about the features of the solution. Depending on the needs of the client and the business, a product concept is identified, as well as the essential elements for implementation. IT specialists determine such details as features, user interface, experience, and many other nuances that determine the subsequent directions of the work. There is an analysis of the work scope, as well as the distribution of responsibilities, choosing the best approach to development.

› Prototype creation

Costs summarize and prototypes’ creation

The complexity and number of functional elements determine the final price for the project. Calculation of the final price list takes place at this stage, after which the preparation of the interface prototype begins. As a rule, the designers take the company’s existing corporate color palette as a fundament, as well as offering several variants of the product’s so-called “appearance.” The client accepts the design or suggests some edits, after which software engineers are provided with the design mockup to start the functionality implementation.

› Product Implementation

As part of this tech-savvy phase, experts select the appropriate tech stack for accounting system building and leverage the appropriate digital tools, solution stacks, programming languages, and frameworks. An integral part of the software implementation process is the selection of the appropriate environment. There are the following options:

- Local deployment. This variant refers to storing and operating the data on physical devices without a distant option. Yet, it’s significant to remember that on-premises solutions are complicated to support and require higher investments for such services.

- Cloud infrastructure. The secure, scalable, and stable cloud environment is pretty advantageous for any business requiring to provide access to real-time information and its alterations. Dynamic company’s demands will be successfully met with adaptive space.

- Web hosting. Online access is the main condition that is necessary when talking about web architecture. The launching process happens with hosting vendors. Hosting is a paid service. It includes renting space on the server and its capacity. The server stores file with the content of the site and upload them when users access the site. The larger the site, the more resources it needs.

› Support

To prolong the life cycle of the product, regular upgrades are a must. Besides, the latest tech tendencies keep offering new solutions that may be beneficial in integration with your software.

» Integral Functionality for Accounting Products

This list of features defines integral elements that should be realized in the solution to make it perform a minimal set of responsibilities:

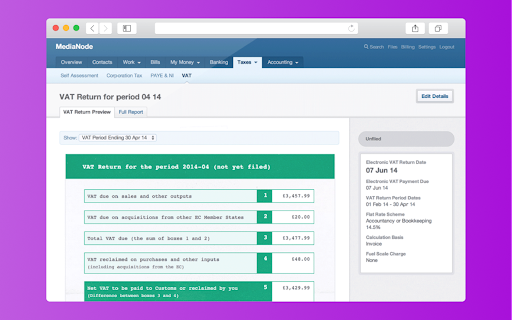

- Value-added tax estimating. The product must primarily perform this type of operation. Automation liquidates possible errors as well as decreases the need for alive employees.

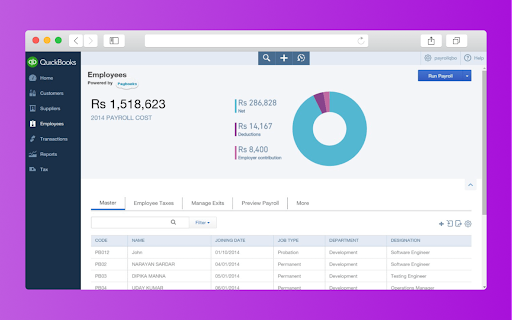

- Salaries management. The sum of the staff’s revenues can be evaluated by such a tool taking into consideration particular time gaps, positions, and salary dynamics.

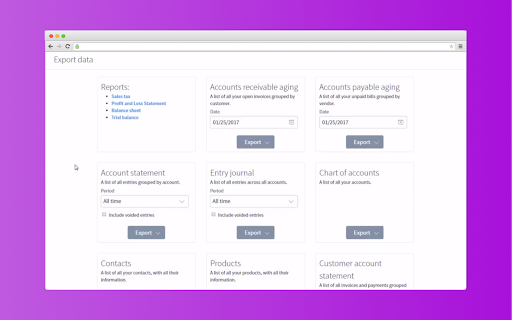

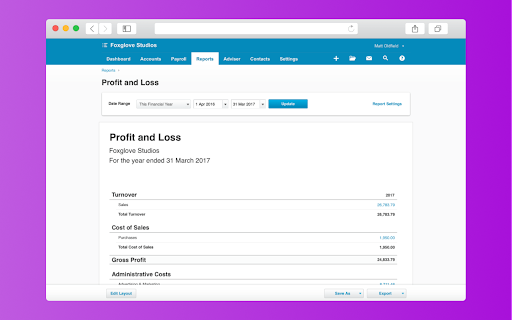

- Insights creation. Accounting can’t happen without insights generation for a set period of time to provide this data to tax organizations. The process of their preparation, as well as conduction of all the key estimates, is performed much quicker and in an automated way.

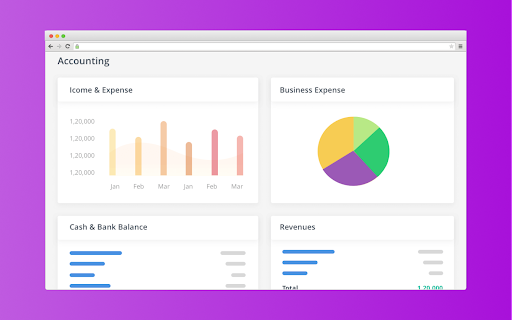

- Visualization. When the data is presented in the form of charts or tables, it becomes much easier to comprehend.

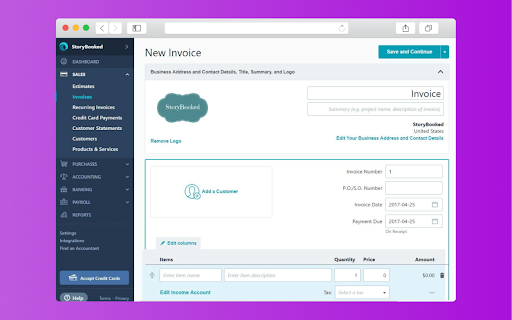

- Section for invoices. Invoices can be efficiently operated, structured, organized, and accessed. Moreover, employees are able to transfer the insights via the solution.

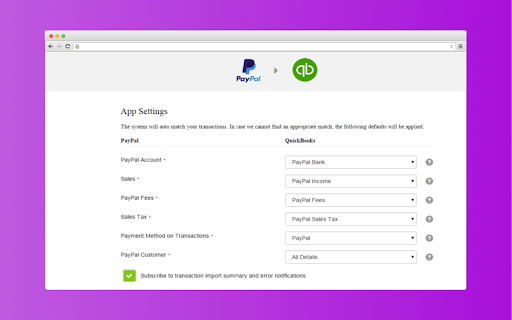

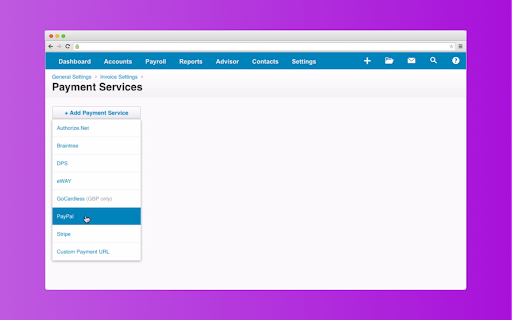

- Payment gateway integration. To perform financial transactions without closing the software, you should implement a feature allowing you to do that easily and conveniently within the solution.

-

- Tracking of credits. It enables entities to observe the customer credit information, manage their debts, and deliver robotized notifications.

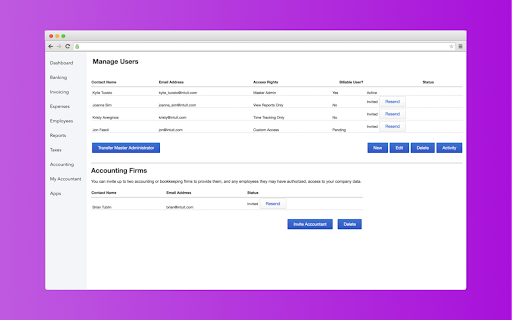

- Security. To make sure that your data is safe, you should be able to manage users and provide them with access on diverse stages.

- Compatibility. The architecture of the accounting solution should be compatible with the other existing products.

- Spending management. The software should be able to track outgoings for diverse periods of time.

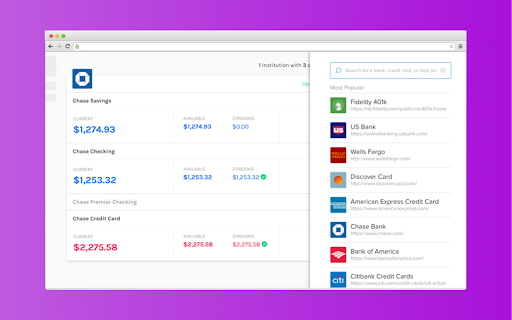

- Bank authorization. Financial manipulations are simpler to perform when employees are able to connect and operate several accounts at once.

» Safety and Protection Prioritizing

Security is key when we are talking about financial manipulations. Fraud takes place in every niche which is tied to money operations. To protect you as well as the company’s reputation and security, you may apply data encryption as well as two-step verification. Such solutions will substantially raise the trustworthiness of your business, which is definitely important.

Besides, we highly recommend consulting with your software development vendor to get more options on how to implement robust security in your solution and what technologies to choose specifically for your case.

» Summarize

We would like to emphasize the fact that accounting software creation is a pretty complex process that requires high technical expertise. For this, you should thoroughly select a software architecture provider, as it’s a key factor predetermining your accounting product’s quality.

Author’s bio : Yuliya Melnik

Yuliya Melnik is a technical writer at Cleveroad. It is a web and mobile app development company in Ukraine. She is passionate about innovative technologies that make the world a better place and loves creating content that evokes vivid emotions.