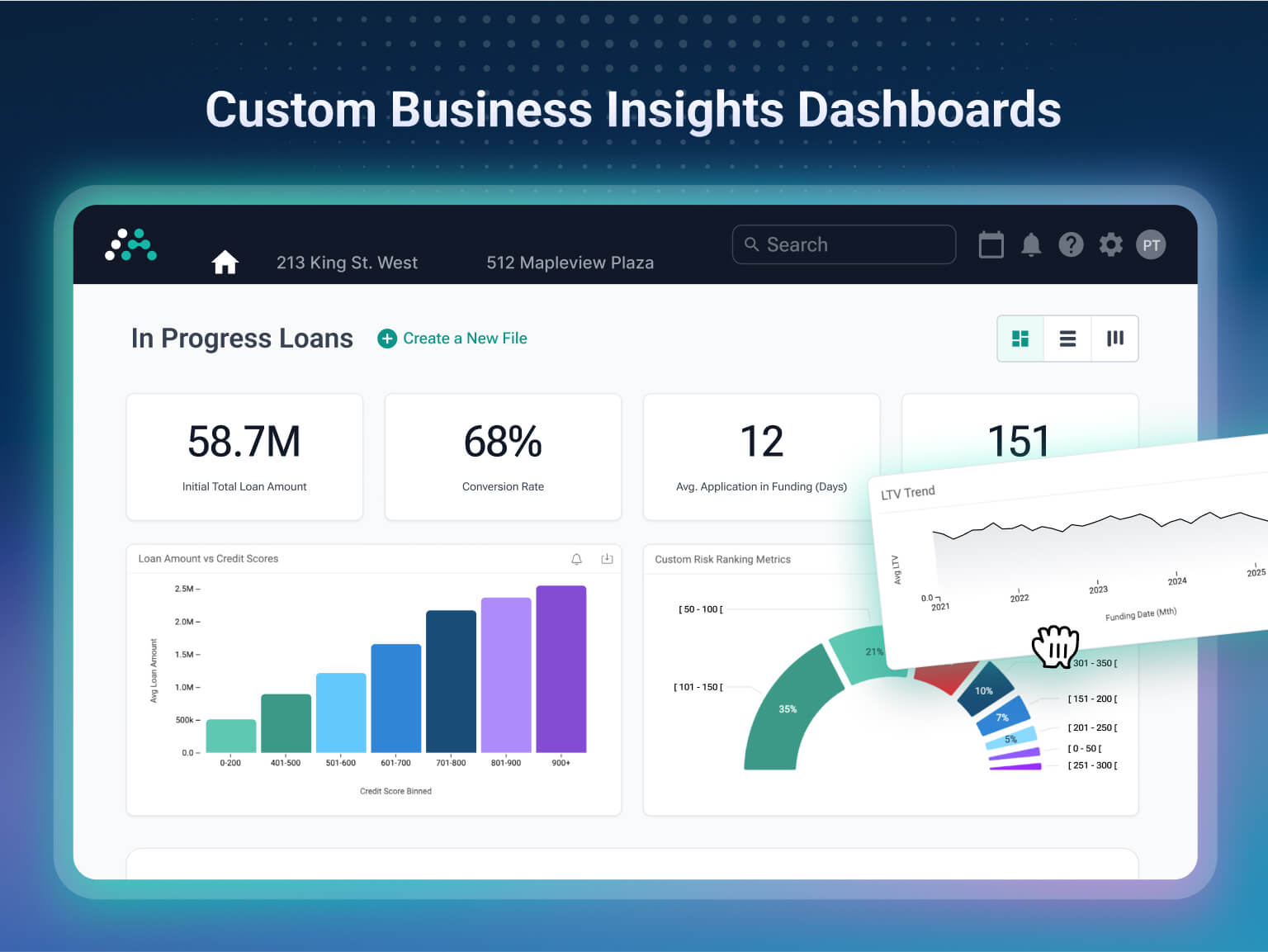

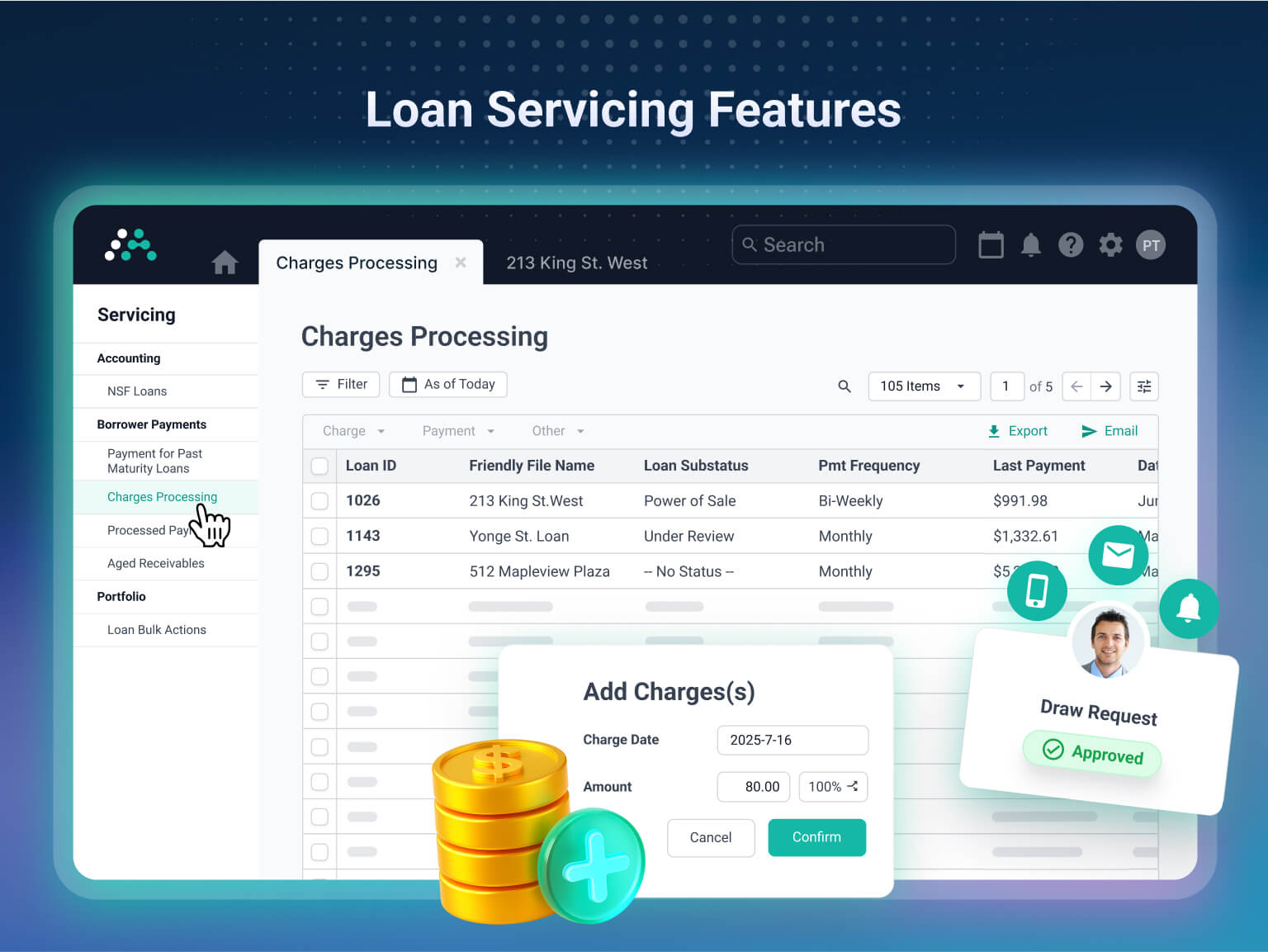

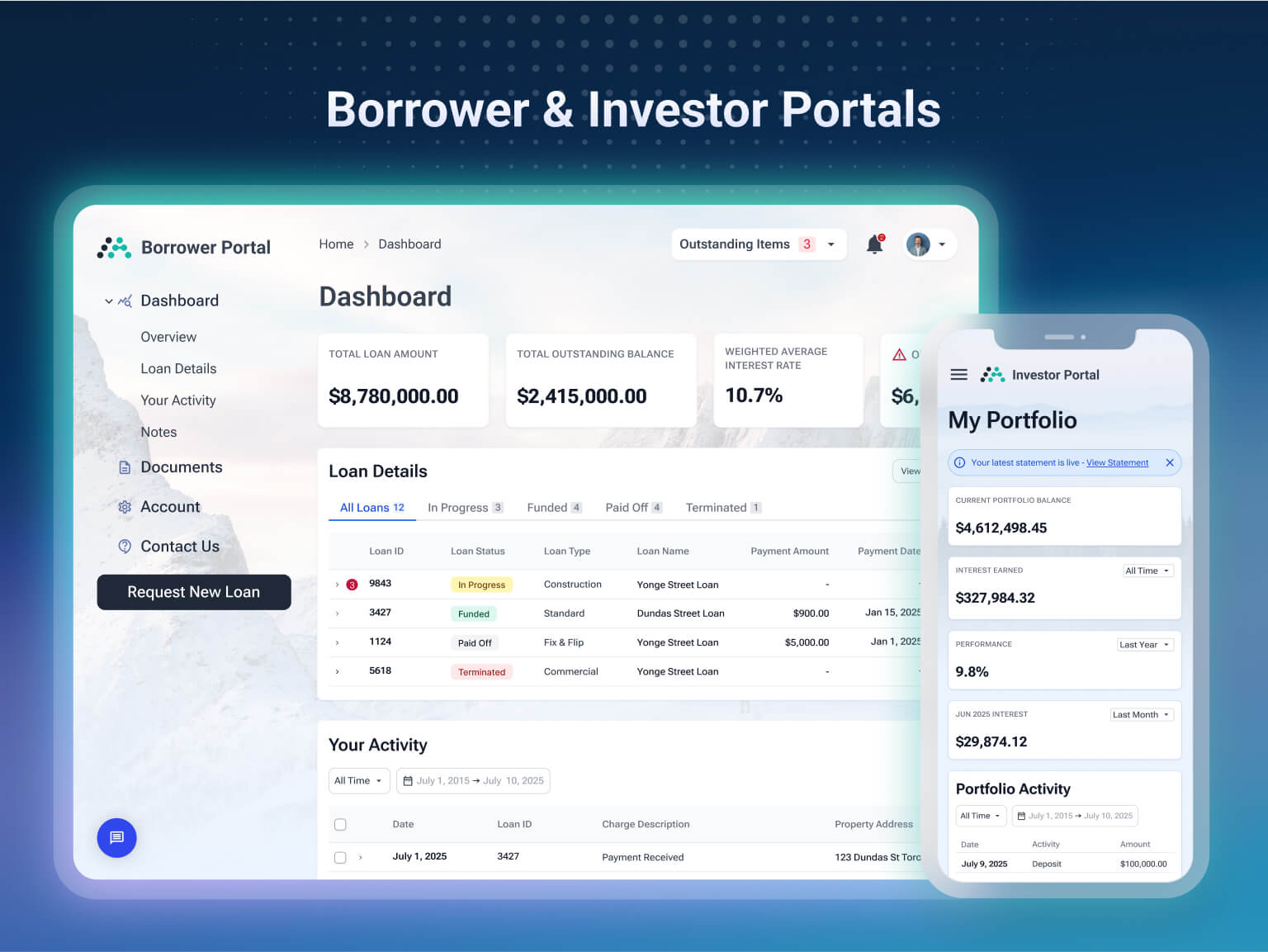

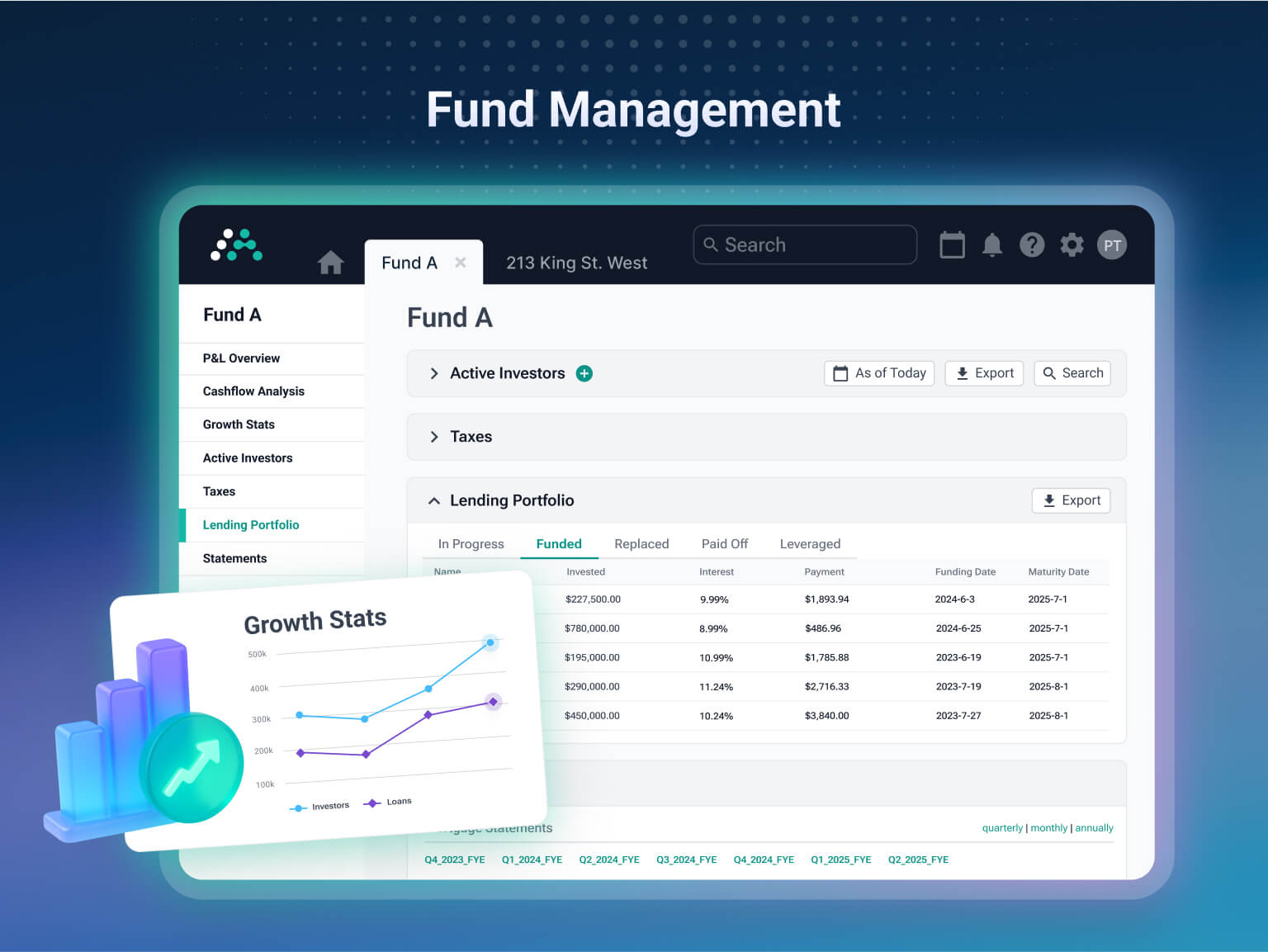

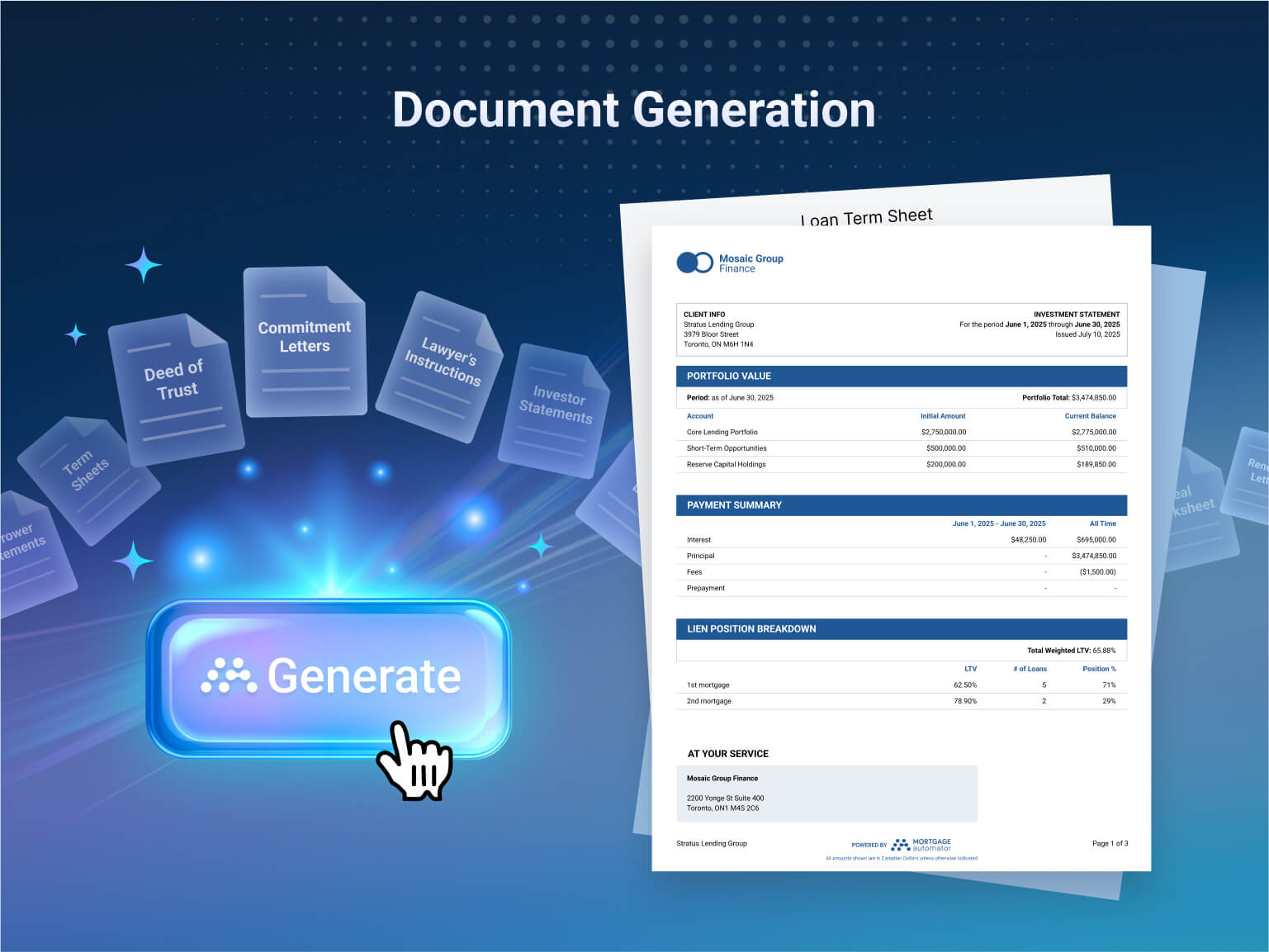

Mortgage Automator is a dynamic, cloud-based software specifically developed for private mortgage lenders and brokers. It streamlines the entire lending process, from origination to closing, with an emphasis on automation and efficiency. The software's standout feature is its ability to automate repetitive tasks, saving time and reducing errors. It offers robust loan tracking, document generation, and management capabilities, ensuring seamless operations. Mortgage Automator also excels in borrower communication, featuring integrated messaging and notification systems. Its user-friendly interface and customizable dashboards make it accessible to users of all skill levels. Additionally, the software includes comprehensive reporting tools, providing valuable insights for decision-making. Overall, Mortgage Automator enhances productivity, ensuring a smoother, more efficient mortgage lending process.

Read More