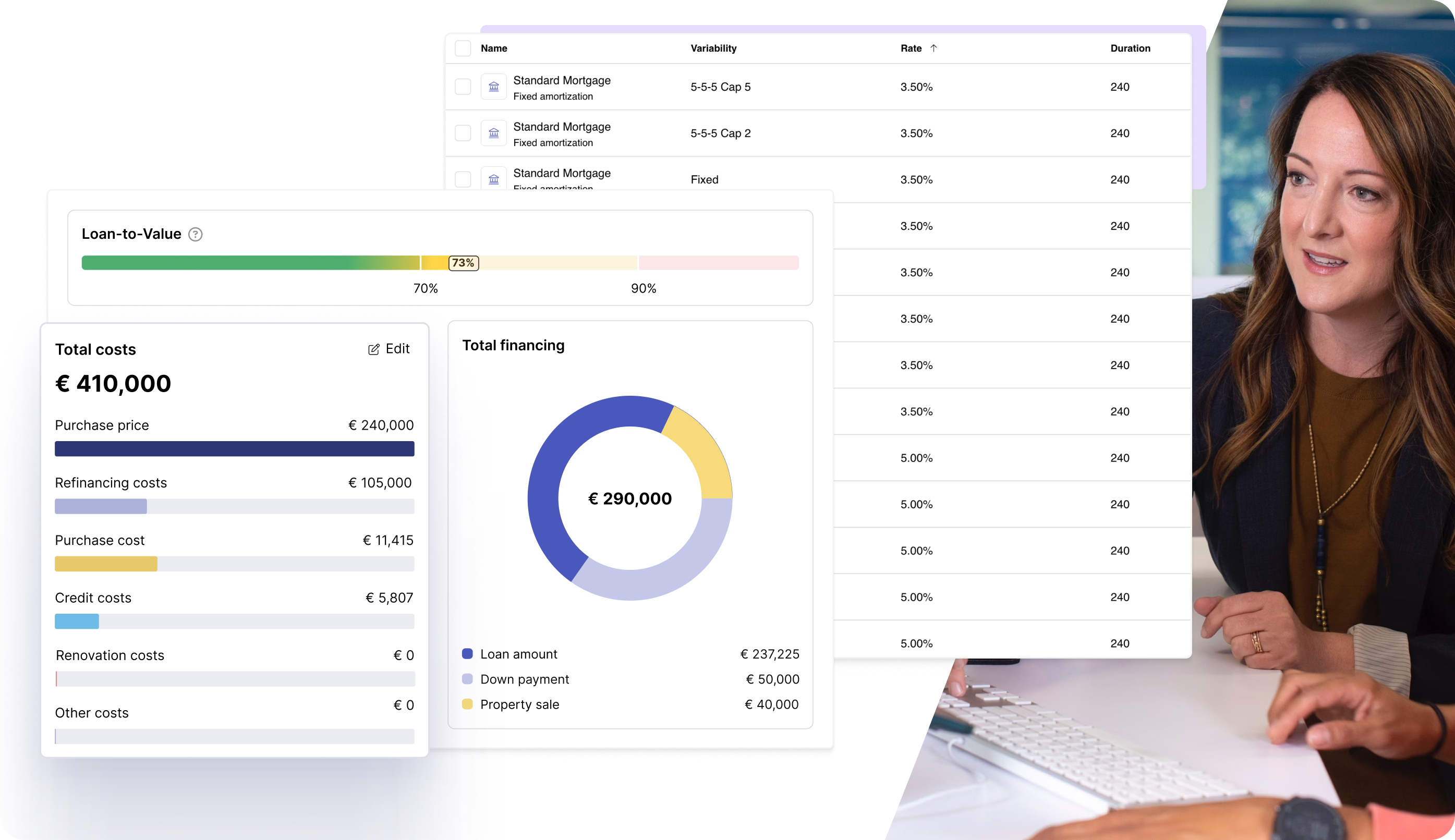

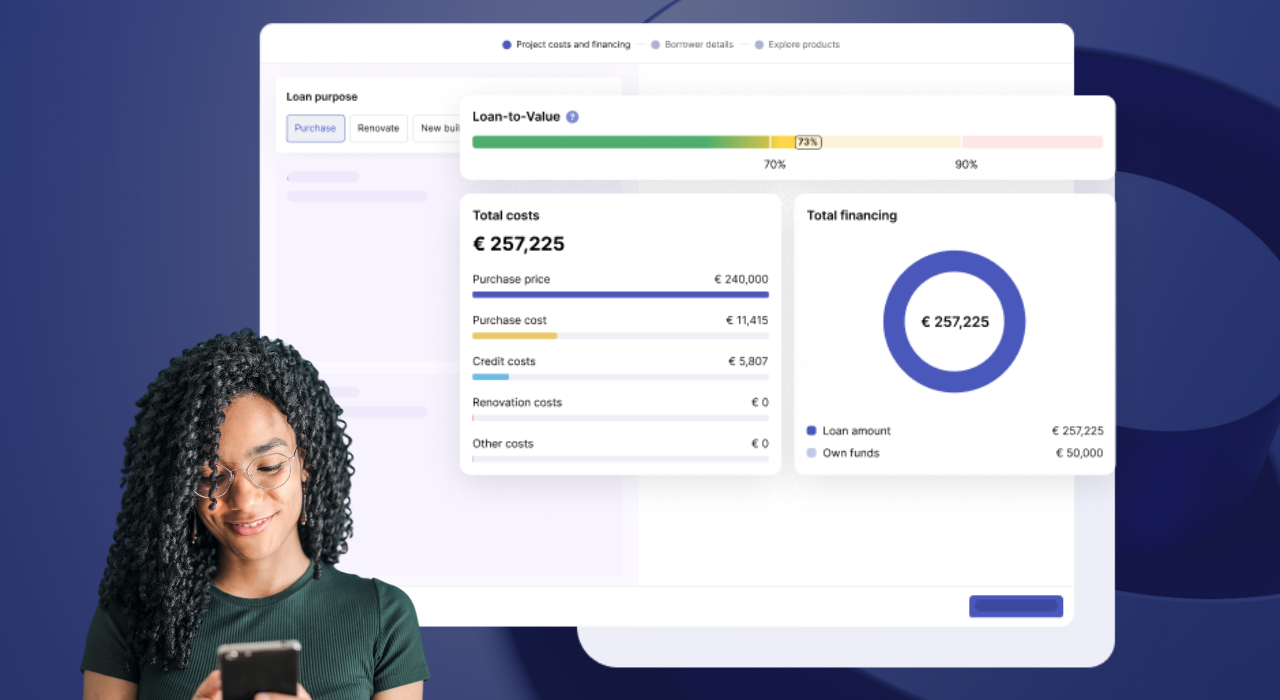

Oper is a leader in cloud-based mortgage software, streamlining processes for borrowers, mortgage advisors and credit analysts. Our platform improves mortgage application, efficiency, eliminates paperwork, and boosts transparency. Partnering with 16 leading financial institutions across 6 European countries, our digital solutions result in a 27% increase in digital customer conversion, 81% faster mortgage decisions, and a 90% improvement in loan request quality. Oper white-label solution integrates seamlessly with core banking systems.

With a team of over 50 mortgage experts, Oper operates from offices in Brussels and Zürich, dedicated to transforming European mortgages. Backed by Bessemer Venture Partners and Motive Ventures, our SaaS platform has raised EUR 14 million, placing Oper at the forefront of mortgage innovation in Europe. To learn more about how Oper helps Europe’s leading digital lenders, visit https://www.opercredits.com/.