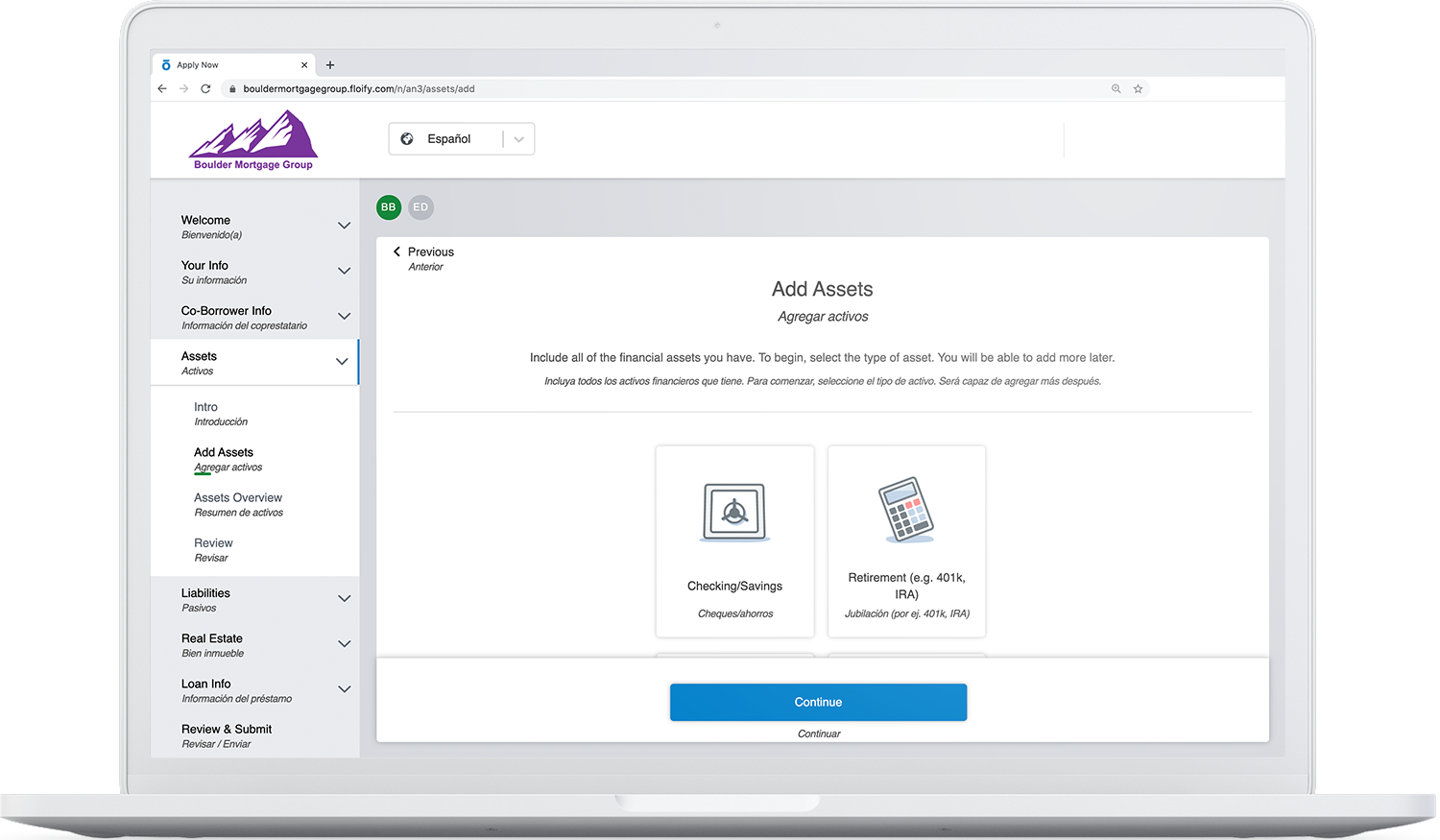

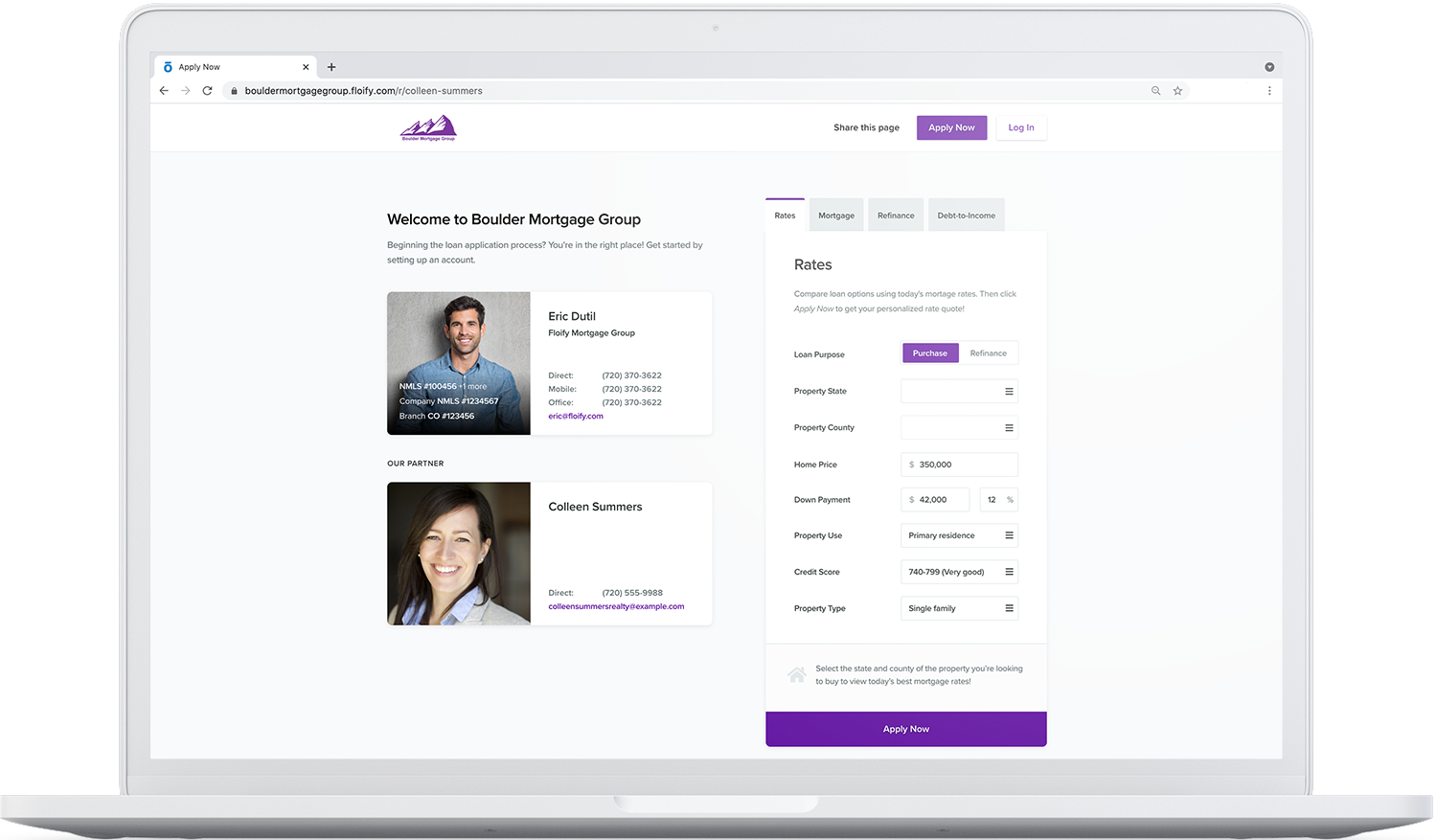

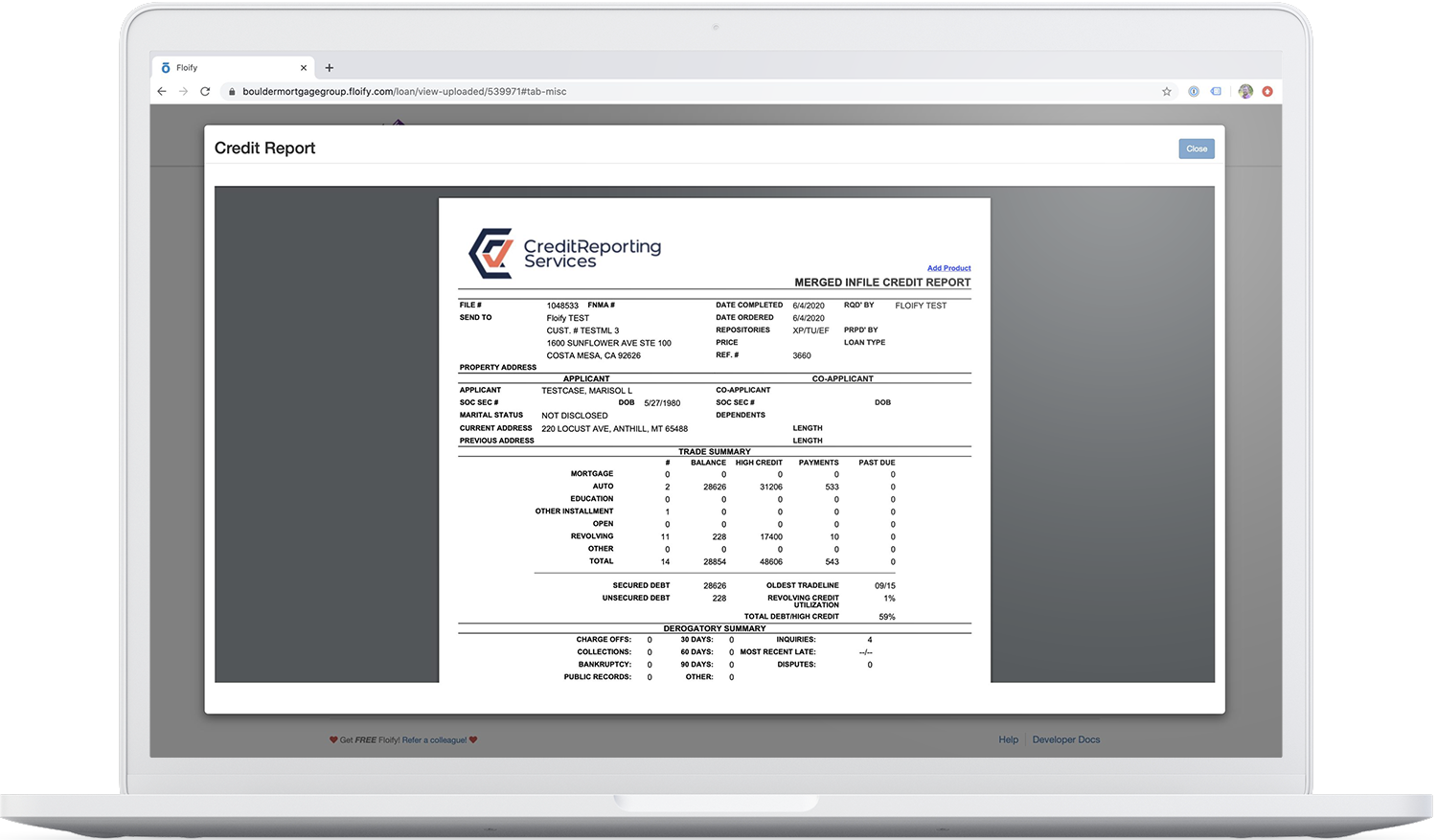

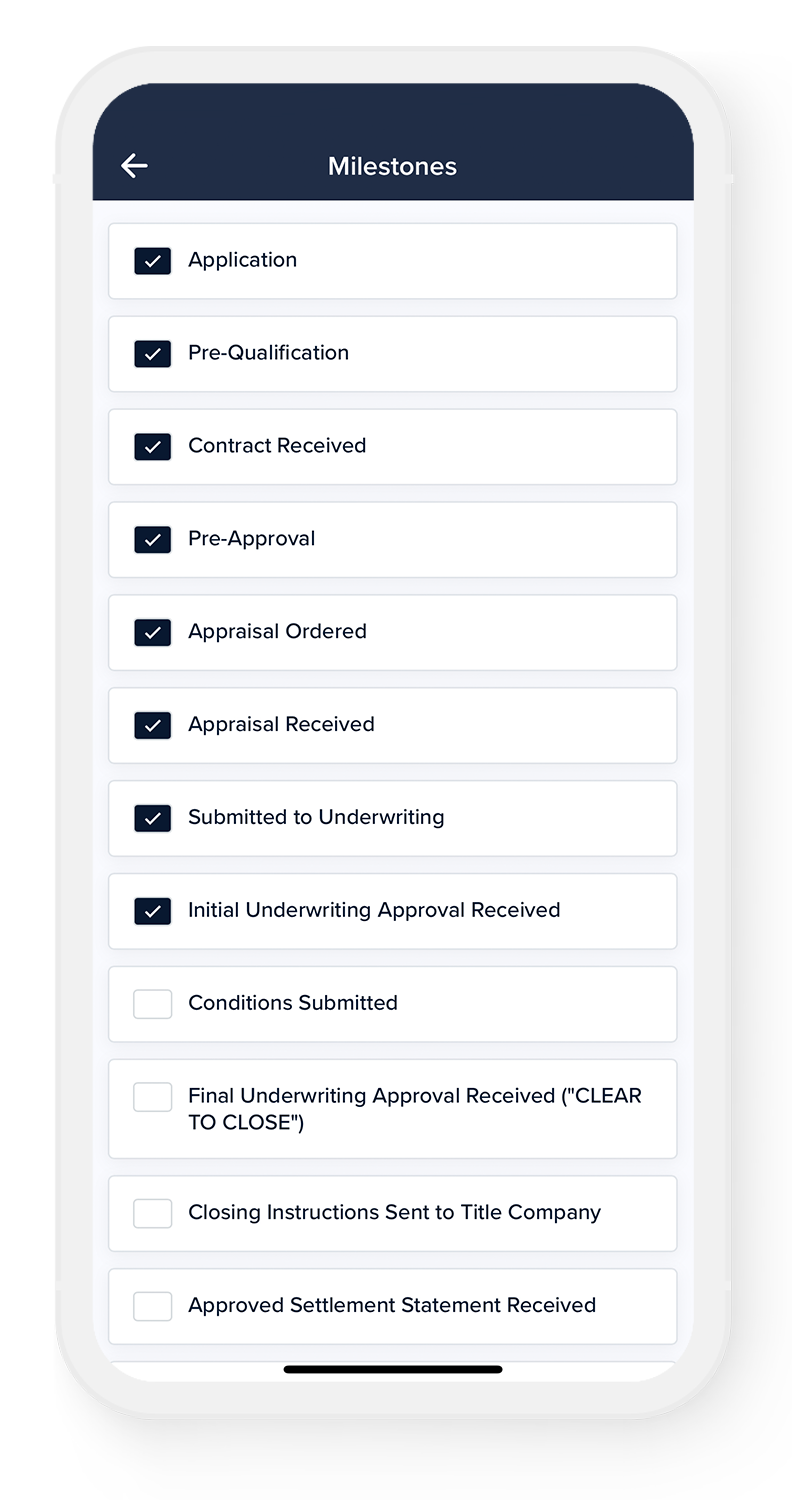

Floify is a cutting-edge mortgage point-of-sale software developed to optimize the loan origination process for lenders and borrowers alike. Its standout feature is the streamlined document collection and management system, which significantly reduces the hassle of paperwork. Floify excels in enhancing communication, offering real-time updates and notifications to keep all parties informed. The platform's intuitive interface simplifies loan application and tracking, making it accessible for users of varying tech skills. Customizable workflows and automated verification tools further increase efficiency, while robust security measures protect sensitive financial data. By integrating with major lending platforms, Floify offers a comprehensive solution, making the mortgage process smoother, faster, and more transparent for everyone involved.

Floify Claim

Your Edge in Mortgage Banking Excellence

Why SoftwareWorld Chooses Floify:

“SoftwareWorld likely chose Floify based on its positive online user reviews highlighting its user-friendly interface, robust features for mortgage automation, and excellent customer support. Users appreciate its seamless integration capabilities, which streamline the loan origination process, enhance productivity, and improve client communication. These factors contribute to its reputation as a reliable and efficient tool in the mortgage industry.”