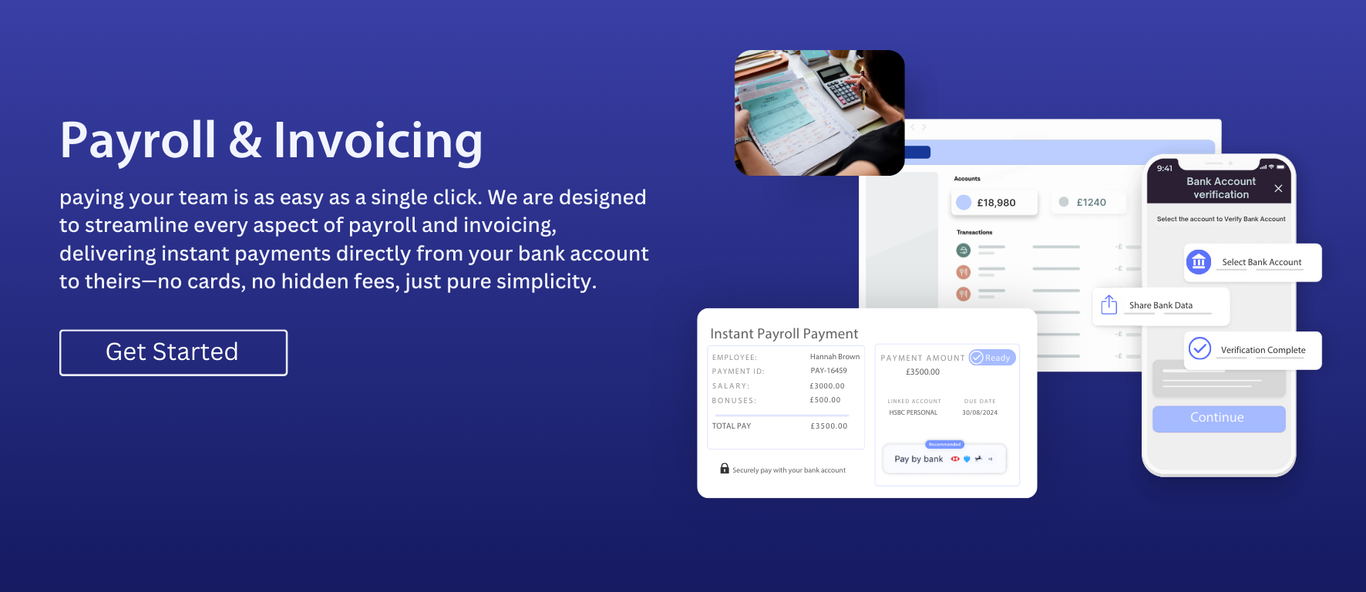

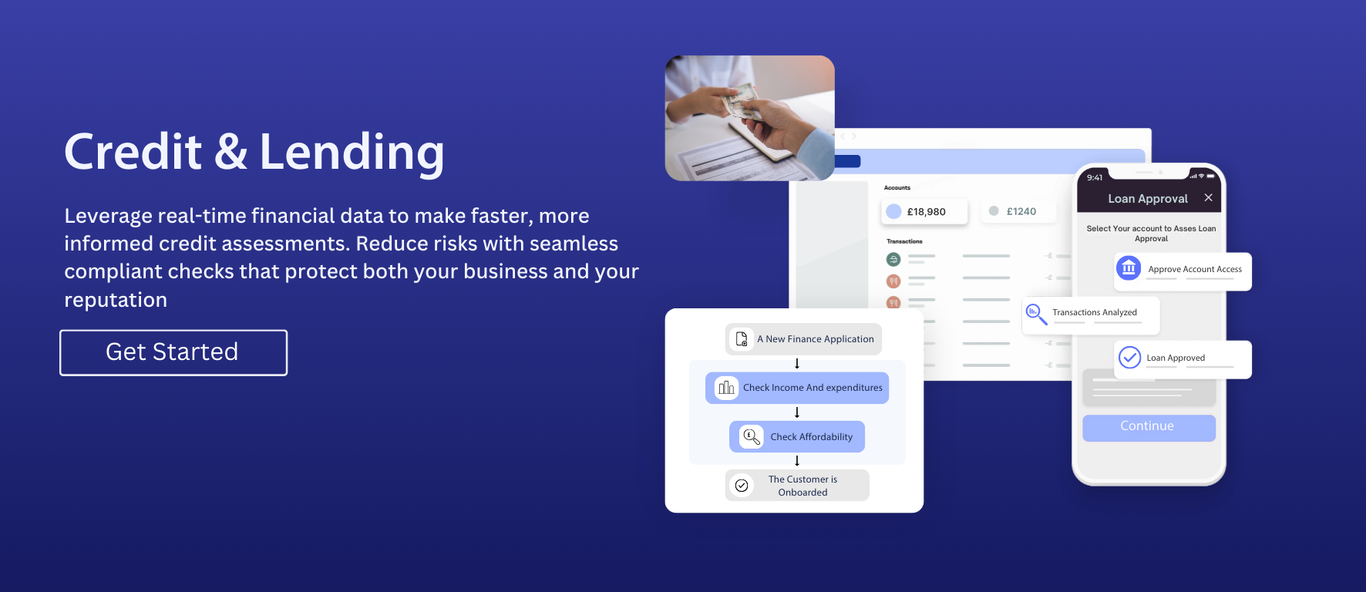

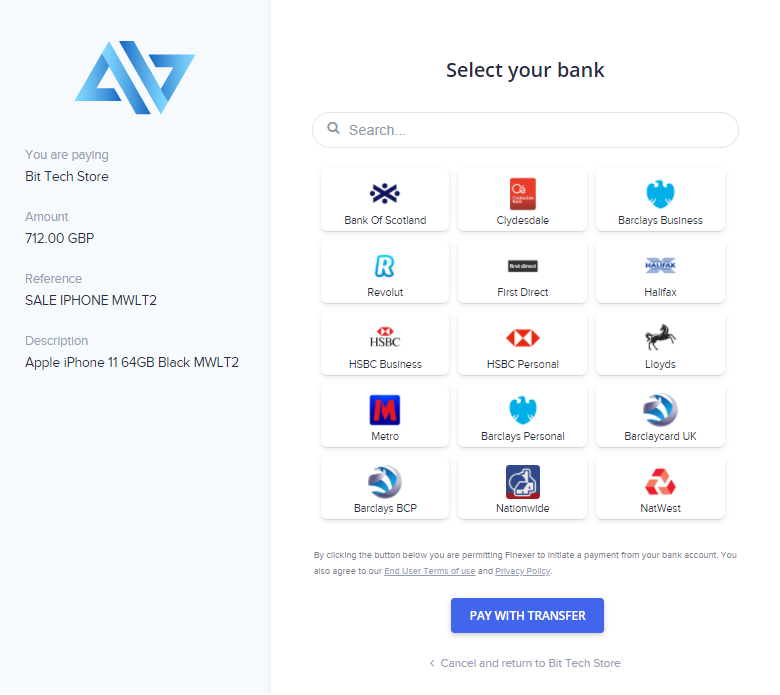

Finexer is an open banking platform that provides businesses with integrated instant payment and enriched financial data solutions. The platform enables real-time access to banking data and seamless Pay-By-Bank transactions. Key features include instant payments, bulk payouts, real-time transaction data, balance checks, and bank-based authentication. Pricing is available upon request from the provider.

Finexer is at the forefront of the open banking revolution, offering robust APIs that enable businesses to access banking transactional data and perform account-to-account (A2A) transactions securely and seamlessly. Our solutions are designed to drive efficiency, enhance customer experiences, and foster financial inclusion across various industries.

At Finexer, we're reshaping the UK's financial landscape by unlocking the transformative power of open banking. Finexer is pioneering the integration of open banking technology, reshaping the financial landscape for businesses and consumers alike. Our platform offers a bridge between businesses and hundreds of banks, enhancing the capabilities of financial services with cutting-edge technology and real-time data access. At Finexer, we make financial transactions smoother, more transparent and customer-focused.

Finexer stands out with its fast deployment, seamless integration, and cost-efficient Open Banking solutions. Unlike traditional payment processors, Finexer enables instant Pay-By-Bank transactions and real-time financial data access. With 2-3x faster onboarding than competitors, a white-label option, and direct connectivity to all UK banks, Finexer simplifies financial operations for businesses of all sizes.

Why Choose Finexer?

3x Faster Deployment – Get up and running quickly with seamless API integration.

Instant Payments & Financial Data – Process real-time transactions and access enriched banking insights.

Secure & Compliant – Fully FCA-regulated, ensuring data privacy and compliance.

Cost-Effective – Reduce transaction costs by up to 90% compared to card payments.

White-Labelled Solution – Customize branding and features to match your business needs.

Our Vision & Commitment

At Finexer, we believe that Open Banking is the future of financial services. Our goal is to create a more efficient, transparent, and inclusive financial ecosystem that benefits businesses and consumers alike.

Our Mission: To simplify financial processes with fast, secure, and user-friendly Open Banking solutions.

Learn More: www.finexer.co.uk